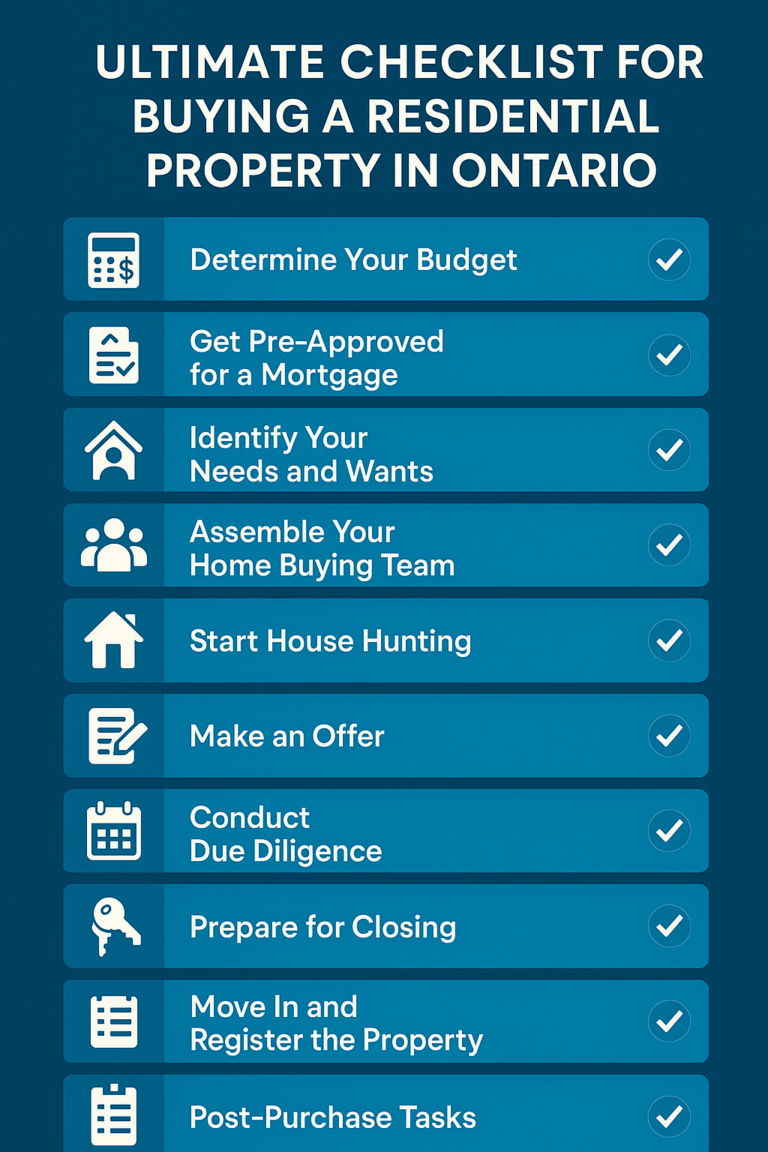

Checklist for Buying a Residential Property in Ontario

Buying a residential property is a major milestone — exciting, life-changing, and a little bit nerve-wracking. Whether you’re a first-time homebuyer or a seasoned investor, navigating Ontario’s real estate market requires careful planning and due diligence. From budgeting to closing, every stage involves critical steps that can impact your financial future.

This comprehensive checklist will guide you through each phase of the home-buying process in Ontario, helping you make informed decisions and avoid costly mistakes.

✅ 1. Determine Your Budget

Before browsing listings, take a hard look at your financial picture.

Steps:

Calculate your total income and monthly expenses.

Determine how much you can afford for a down payment and ongoing mortgage payments.

Use the CMHC’s affordability calculator to estimate realistic price ranges.

Factor in closing costs (typically 1.5%–4% of the purchase price), including land transfer tax, legal fees, inspections, and more.

Tip: In Ontario, if you’re a first-time homebuyer, you may qualify for a Land Transfer Tax Rebate of up to $4,000.

✅ 2. Get Pre-Approved for a Mortgage

Getting pre-approved gives you a clear idea of how much you can borrow and shows sellers you’re a serious buyer.

Documents you’ll need:

Proof of income (pay stubs, T4s, employment letter)

Tax returns

Credit history

List of assets and debts

Bank statements

Pro tip: Shop around for the best mortgage rates and terms. Use a mortgage broker for access to multiple lenders.

✅ 3. Identify Your Needs and Wants

Start defining your must-haves versus nice-to-haves.

Considerations:

Location: Proximity to work, schools, transit, amenities

Property type: Condo, townhouse, semi-detached, detached

Size and layout: Number of bedrooms/bathrooms, square footage

Future growth: Is this a starter home or long-term residence?

Think ahead: Consider how your lifestyle might change in 5–10 years — family planning, remote work, accessibility needs, etc.

✅ 4. Assemble Your Home Buying Team

Having the right professionals on your side can make or break your experience.

Your dream team:

Real estate agent: Preferably one with experience in your target neighbourhood and property type.

Mortgage broker/lender

Real estate lawyer: Essential for reviewing contracts, managing the closing process, and conducting title searches.

Home inspector: Crucial for evaluating property condition before purchase.

✅ 5. Start House Hunting

Now the fun begins — visiting properties! But don’t let excitement cloud your judgment.

Tips:

Don’t skip open houses.

Take notes and photos during each showing.

Ask about property history, renovations, age of roof/furnace/windows.

Check the neighborhood during different times of day for noise, traffic, and safety.

Consider resale value and neighbourhood appreciation trends.

Note: Be patient. It may take time to find the right fit.

✅ 6. Make an Offer

Once you’ve found “the one,” your real estate agent will help you draft and submit a formal offer.

Key parts of an offer:

Price

Deposit (usually 5% of the offer price)

Closing date

Inclusions (appliances, light fixtures, etc.)

Conditions (e.g., financing, home inspection)

Common conditions in Ontario:

Financing condition: Gives you time to secure a mortgage.

Home inspection condition: Allows you to back out or renegotiate if issues are found.

Status certificate review (for condos): A lawyer reviews the condo’s financial and legal health.

✅ 7. Conduct Due Diligence

Before waiving any conditions, complete these vital steps:

Home Inspection:

A qualified inspector assesses foundation, plumbing, electrical, roofing, HVAC, insulation, and more.

You’ll receive a detailed report outlining repairs or risks.

Mortgage Approval:

Once your offer is accepted, submit it to your lender for final approval.

Don’t make large purchases or change jobs during this time.

Condo Buyers:

Review the Status Certificate for financial statements, reserve fund details, bylaws, and ongoing legal disputes.

Pro tip: If major issues arise, you can renegotiate the price or walk away — if your conditions allow.

✅ 8. Prepare for Closing

Closing is when the legal transfer of property takes place, and it requires preparation.

Steps:

Hire a real estate lawyer to manage title transfer, land registry, and funds disbursement.

Arrange home insurance — most lenders require proof before finalizing your mortgage.

Transfer utilities (hydro, water, gas, internet) to your name.

Conduct a final walkthrough to ensure the property is in agreed-upon condition.

Closing Costs to Budget For:

Legal fees: $1,000–$2,500

Land Transfer Tax (provincial and possibly municipal in Toronto)

Title insurance: ~$300–$500

Property tax adjustments

Mortgage insurance (if applicable)

Moving expenses

✅ 9. Move In and Register the Property

On closing day, your lawyer will:

Transfer the property title to your name

Release the mortgage funds

Pay out the seller

Register your ownership with the Ontario Land Registry

Once you have the keys, you’re officially a homeowner!

✅ 10. Post-Purchase Tasks

Your responsibilities don’t end on moving day.

Ongoing steps:

Update your address with banks, government agencies, and service providers.

Set up a maintenance schedule for HVAC, gutters, and roof inspections.

Budget for repairs, improvements, and property taxes.

Consider setting up a home emergency fund.

Bonus Tips for Buying in Ontario

Understand Ontario-specific laws: For example, Ontario has stringent rules around multiple representation (when the same real estate agent represents both buyer and seller).

Beware of bidding wars: Hot markets like Toronto can lead to emotional overspending. Set a firm upper limit.

Check for development plans: Use Ontario’s Municipal Property Assessment Corporation (MPAC) and local planning offices to check zoning, developments, or rezoning proposals.

Review school rankings and crime stats if those matter to you.

Final Thoughts

Buying a home in Ontario is more than a transaction — it’s a deeply personal journey. The more informed and prepared you are, the smoother and more successful your experience will be. Use this checklist as your step-by-step roadmap, and don’t hesitate to lean on professionals for guidance.

Whether you’re moving into a bustling Toronto condo, a cozy Ottawa townhouse, or a quiet home in cottage country, this checklist ensures you’re ready for one of life’s most significant investments.