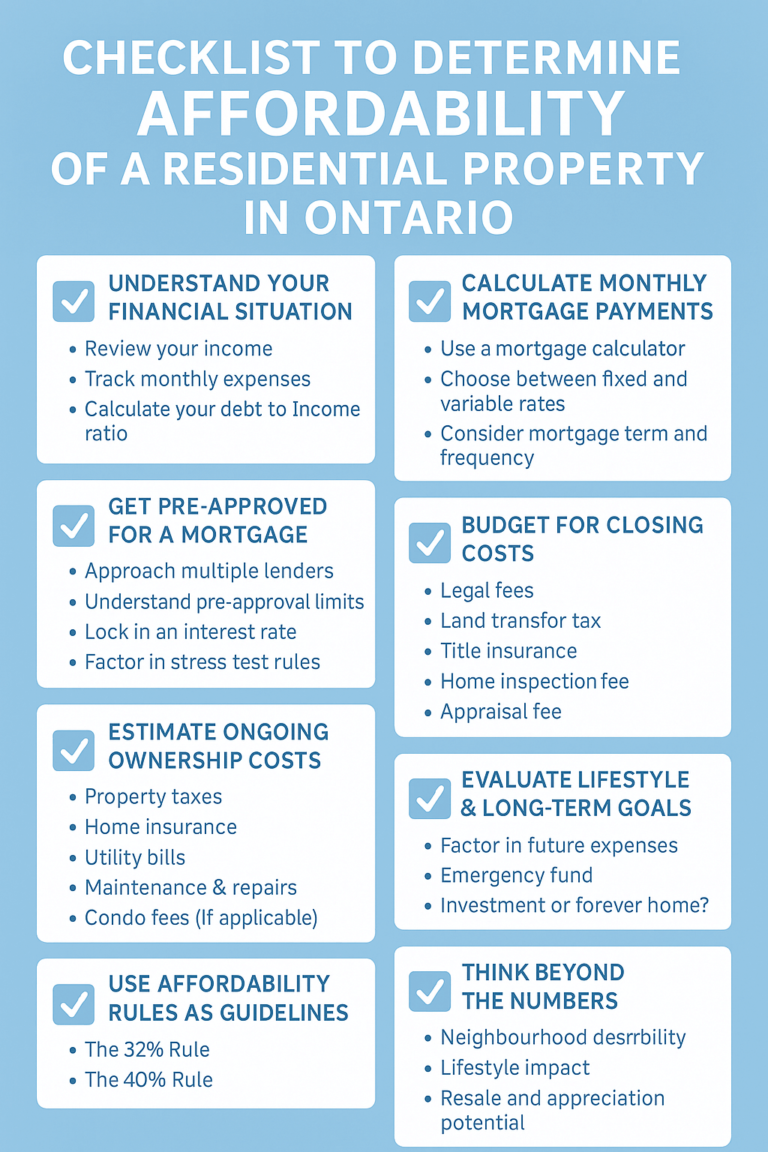

Checklist to Determine Affordability of a Residential Property in Ontario

Buying a home is a significant milestone and financial decision. In Ontario, where housing prices can vary dramatically depending on location, determining what you can afford is the crucial first step in your homeownership journey. Affordability doesn’t just mean the purchase price — it includes mortgage payments, taxes, insurance, maintenance, and your overall financial health.

Below is a comprehensive checklist to help you determine whether a residential property is affordable for you in Ontario.

1. Understand Your Financial Situation

✅ Review Your Income

Start by calculating your total monthly household income (after taxes). Include all income sources: salary, side hustles, investments, and rental income if any.

✅ Track Monthly Expenses

Create a detailed breakdown of your fixed and variable expenses — rent (if applicable), food, transportation, childcare, subscriptions, entertainment, and savings.

✅ Calculate Your Debt-to-Income Ratio (DTI)

Lenders use this ratio to assess your ability to take on new debt. Add up all monthly debt payments (credit cards, student loans, car loans) and divide by your gross monthly income.

✅ Ideal DTI Ratio: 36% or less.

2. Determine Your Down Payment Capacity

✅ Know the Minimum Down Payment Requirements

In Canada, the minimum down payment depends on the home’s purchase price:

5% for homes up to $500,000

10% for the portion between $500,000 and $999,999

20% for homes $1 million and above

✅ Save for More Than the Minimum

The larger your down payment, the smaller your mortgage and monthly payments. If your down payment is under 20%, you must purchase mortgage default insurance through CMHC, Sagen, or Canada Guaranty.

✅ Account for the Source of Funds

Lenders ask for proof of where your down payment comes from. It can include:

Personal savings

RRSP withdrawals (via the Home Buyers’ Plan)

Gifts from family

3. Get Pre-Approved for a Mortgage

✅ Approach Multiple Lenders

Don’t settle for the first offer. Shop around banks, credit unions, and mortgage brokers.

✅ Understand Pre-Approval Limits

Pre-approval gives you an estimate of how much a lender is willing to loan based on your financial profile. However, it’s not a guarantee.

✅ Lock in an Interest Rate

Most pre-approvals lock in rates for 90 to 120 days. This protects you if interest rates rise during your home search.

✅ Factor in Stress Test Rules

As of 2024, the mortgage stress test requires buyers to qualify at either:

The mortgage rate plus 2%, or

The benchmark rate (currently 5.25%),

whichever is higher.

4. Calculate Monthly Mortgage Payments

✅ Use a Mortgage Calculator

Plug in the home price, down payment, interest rate, and amortization period (typically 25 or 30 years) to estimate your monthly payments.

✅ Choose Between Fixed and Variable Rates

Fixed rate: Predictable payments, ideal in rising-rate environments.

Variable rate: Often lower initially but can increase.

✅ Consider Mortgage Term and Frequency

Shorter terms usually have lower interest rates but need renewal more often. Also decide whether to pay monthly, biweekly, or weekly.

5. Budget for Closing Costs

✅ Legal Fees

Typically range between $1,500 and $3,000.

✅ Land Transfer Tax

Ontario charges this based on the home’s value. If you’re buying in Toronto, expect a second municipal tax.

Tip: First-time home buyers may qualify for rebates up to $4,000 (Ontario) and $4,475 (Toronto).

✅ Title Insurance

One-time cost of $250–$500 to protect against title fraud or ownership disputes.

✅ Home Inspection Fee

Usually $400–$700 — optional but strongly recommended.

✅ Appraisal Fee

Some lenders require this; costs range from $300 to $500.

6. Estimate Ongoing Ownership Costs

✅ Property Taxes

Municipal property tax rates vary by location but generally fall between 0.6% and 1.5% of the assessed home value per year.

✅ Home Insurance

Basic policies typically cost $700–$1,500 per year, depending on home type, location, and coverage.

✅ Utility Bills

Factor in electricity, water, gas, and heating costs. These can average $200–$400/month.

✅ Maintenance & Repairs

Rule of thumb: budget 1% of your home’s value annually. For a $700,000 home, that’s around $7,000 per year.

✅ Condo Fees (if applicable)

Monthly maintenance fees range from $300 to over $1,000, depending on the building and amenities.

7. Evaluate Lifestyle & Long-Term Goals

✅ Factor in Future Expenses

Will your costs rise soon due to:

Expanding family?

Childcare or education?

Job changes?

✅ Emergency Fund

Keep 3 to 6 months’ worth of expenses in a savings account. Homeownership comes with surprises — from roof repairs to appliance failures.

✅ Investment or Forever Home?

Are you buying a starter home or your long-term dream house? Your affordability limits and willingness to stretch may differ.

8. Use Affordability Rules as Guidelines

There are some common affordability benchmarks you can use:

The 32% Rule: Your gross monthly housing costs (mortgage, taxes, heat, and 50% of condo fees) shouldn’t exceed 32% of your gross income.

The 40% Rule: Total monthly debt payments (including housing and other loans) should not exceed 40% of gross income.

These are known as Gross Debt Service (GDS) and Total Debt Service (TDS) ratios — critical numbers lenders use in approval decisions.

9. Think Beyond the Numbers

✅ Neighborhood Desirability

A cheaper home in a less accessible area may come with hidden costs (e.g., longer commutes, limited services). Consider transit, schools, parks, safety, and resale potential.

✅ Lifestyle Impact

Will owning the home limit your ability to travel, save, or invest? Don’t let house fever blind you to the trade-offs.

✅ Resale and Appreciation Potential

Consider whether the property aligns with long-term market trends. Condos in some areas appreciate more slowly than detached homes.

10. Consult with Experts

✅ Mortgage Broker

Can help compare lender products and secure pre-approvals tailored to your profile.

✅ Financial Advisor

Ensure your home buying aligns with retirement, investment, and debt-repayment goals.

✅ Real Estate Agent

Experienced agents can help identify good-value homes and realistic price points in your desired areas.

✅ Lawyer or Notary

They’ll guide you through the legal and regulatory process and flag hidden costs.

Final Thoughts

Determining whether you can afford a residential property in Ontario requires more than checking if you can make a mortgage payment. It means evaluating every cost involved — now and in the future — while staying honest about your financial comfort zone.

By following this affordability checklist, you’ll set yourself up for a successful and stress-free homebuying experience, no matter where in Ontario you choose to settle.